Portfolio item number 1

Short description of portfolio item number 1 Read more

Read more

Short description of portfolio item number 1 Read more

Read more

Short description of portfolio item number 2  Read more

Read more

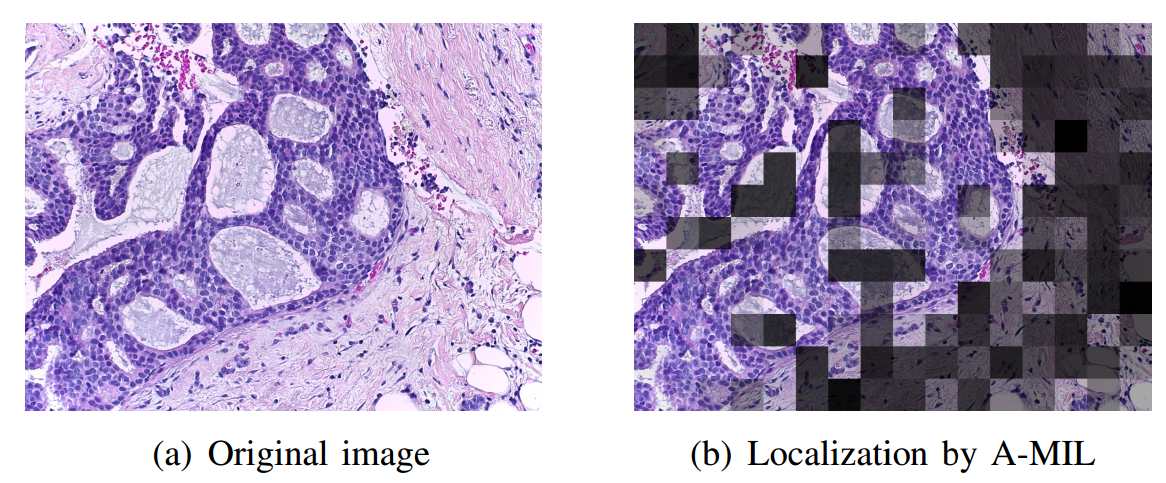

Published in IEEE WIECON 2019, 2019

This paper presents a multiple-instance learning based method for classifcation and localization of breast cancer in histopathology images. Read more

Published:

Read more

Read morePublished:

More information here This project is based on recognizing potholes and avoiding road accidents.

Published:

This talk presents an overview of the domain of deep learning.

Published:

Published:

Published:

Undergraduate course, University 1, Department, 2014

This is a description of a teaching experience. You can use markdown like any other post.

Workshop, University 1, Department, 2015

This is a description of a teaching experience. You can use markdown like any other post.